schedule c tax form meaning

Ad File your 1040 with a Schedule C for free. You will need to file Schedule C annually as an attachment to your Form 1040.

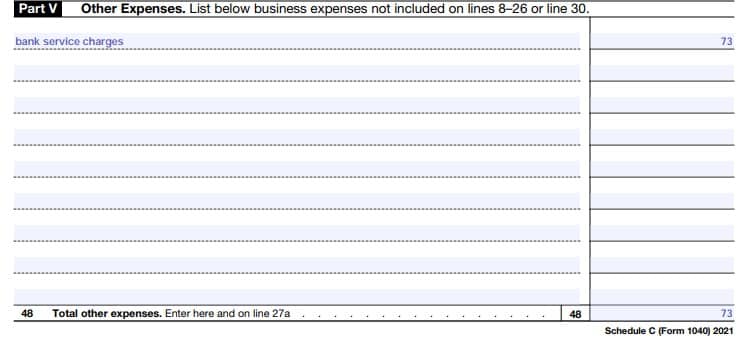

What Do The Expense Entries On The Schedule C Mean Support

The profit is the amount of money you made after covering all of your business expenses and obligations.

. You must send Form 1099-NEC to those whom you pay 600 or more. To be deductible on Schedule C expenses must be both. About Form 1099-MISC Miscellaneous Income.

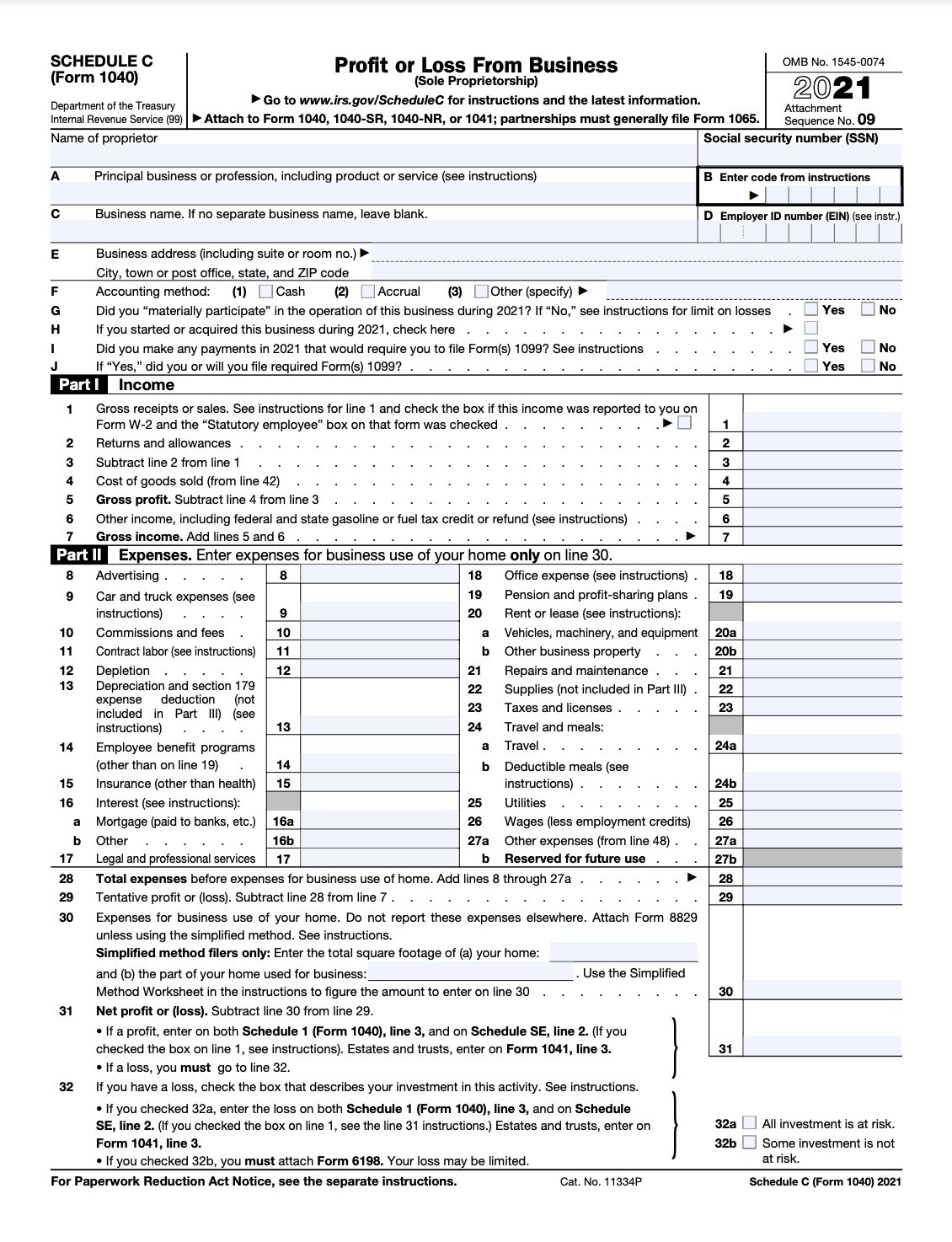

Your loss may be limited. The IRS Schedule C Profit or Loss from Business is a tax document that you submit with your Form 1040 to detail your businesss income and costs. Legal Accounting or Professional Service s.

An activity qualifies as a business if. Schedule C is where you record your business income and expenses and your overall profit or loss for that tax year. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

You must send a copy of the 1099-NEC to the IRS. Payments to contractors freelancers or other small-business people can go on Line 11. An organization that answered Yes on Form 990-EZ Part V line 35c because it is subject to the section 6033 e notice and reporting requirements and.

Before 2020 you would have reported those payments on Form 1099-MISC. This is the amount the IRS taxes not your income. Income Tax Return for Estates and Trusts.

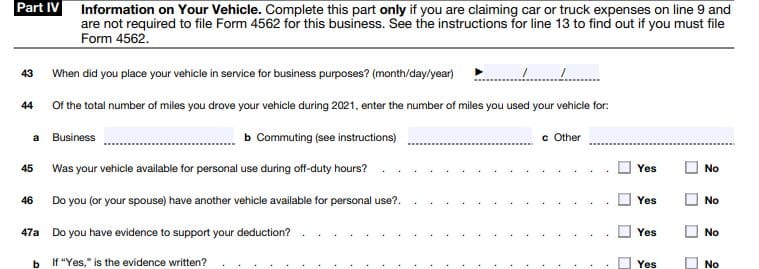

The profit or loss that results is usually classified as self-employment income. In 2018 the last year reported more than 27 million small business owners filed their tax returns using Schedule C. Complete Edit or Print Tax Forms Instantly.

This will help you complete your tax forms. Form 1041 line 3. For example meal expenses generally need to be while youre.

Its used to report income from rental property partnerships S corporations and other types of supplemental income. An organization that answered Yes on Form 990-EZ Part V line 46 or Part VI line 47 must complete the appropriate parts of Schedule C Form 990 and attach Schedule C to Form 990-EZ. If you checked 32b you.

The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. Form 1041 line 3. Schedule 1 Form 1040 or 1040-SR line 3 or.

Schedule E is a tax form filed by individual business owners as part of their personal tax return preparation. Schedule C is used to report profits and losses from a business. If you are self-employed or receive 1099-NEC Forms youll likely need to use Schedule C to report income and expenses for your trade or business.

Here are a few tips for Schedule C filers. All investment is at risk. Complete Edit or Print Tax Forms Instantly.

If the total of your net earnings from self-employment from all businesses is 400 or more use Schedule SE Form 1040 Self-Employment Tax to figure your net earnings from self-employment and tax owed. A Schedule C Form is the way you report any self employed earnings to the IRS. Schedule SE line 2.

About Form 3800 General Business Credit. Form 1040-NR line 13 and on. The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax professional that is an authorized IRS e-file provider.

Its for businesses that are an unincorporated sole. Ad Access IRS Tax Forms. Report your income and expenses from your sole proprietorship on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship.

If a loss you. Schedule SE line 2. Its used to report profit or loss and to include this information in the owners personal tax returns for the year.

Go to line 32 31 32. If you checked the box on line 1 see the line 31 instructions. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. If you checked 32a enter the loss on both. Keep in mind that just because a type of expense is listed doesnt mean you can deduct everything related to it or that you can deduct it in full.

Federal filing is always free for everyone. Schedule C is a schedule to Form 1040 Individual Tax Return. Estates and trusts enter on.

Schedule C is used to report income and expenses from a business you own as a sole proprietor or single-member LLC. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

This article discusses Schedule E what types of income it reports and how to complete and file this form. Schedule 1 Form 1040 line 3 and on. However you can deduct one-half of your self-employment tax on Schedule 1 Form 1040 line 15 but if filing Form 1040-NR then only when covered under the US.

About Form 1041 US. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Social security system due to an.

If you checked the box on line 1 see the line 31 instructions. If you have a loss check the box that describes your investment in this activity. Its part of your individual tax return you just attach it to your 1040 Form at tax time.

Ad Access IRS Tax Forms. This Schedule provides a recap of your companys income and expenses.

Business Activity Code For Taxes Fundsnet

How To Fill Out Your 2021 Schedule C With Example

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

How To Fill Out Your 2021 Schedule C With Example

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

How To Fill Out Your 2021 Schedule C With Example

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

What Is Schedule C Tax Form Form 1040

How To Fill Out Your 2021 Schedule C With Example

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

What Is Schedule C Tax Form Form 1040

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

What Do The Expense Entries On The Schedule C Mean Support

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition