federal estate tax exemption 2022

The current federal estate tax exemption amount is 11700000 per person. Estate Tax Exemption goes up for 2022.

2022 State Business Tax Climate Index Tax Foundation

Their federal estate tax exemption is.

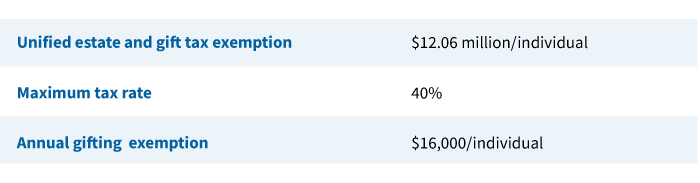

. The tax reform law doubled the BEA for tax-years 2018 through 2025. For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

This set the stage for greater. Because the BEA is adjusted annually for inflation the 2018. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022.

A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The maximum Federal tax rate is 40.

Find Everything about your Search and Start Saving Now. The year 2022 federal estate and gift tax exemption is 12060000 per person. Applying the most recent.

If the date of death value of the decedents US-situated assets together with the gift tax specific exemption and the amount of the adjusted taxable gifts exceeds the filing. The estate tax exemption is often adjusted annually to reflect changes in inflation every year. Executor may elect for the estate tax and step-up in basis rules not to apply to a 2010 decedent.

Learn More at AARP. With an estate tax of 40 the. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

1 You can give up to those amounts over. The new 2022 Estate Tax Rate will be effective. Commencing January 1 2022 the New York State Estate Tax Exemption amount is 611000000 per person.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. The irs has announced that in 2022 the estate and gift tax exemption will be increased to. This election results in the application of the modifi ed carryover basis rules to the estate.

For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples. The 2022 federal estate exemption is at an all-time high increasing from 600000 in 1997 to 1206 million. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

This becomes 24120000 for a married couple. How did the tax reform law change gift and estate taxes. The 2022 exemption is the largest in history but it wont last.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The federal estate tax exemption for 2022 is 1206 million. Estate Tax Exemption goes up for 2022.

The federal estate tax exemption rate slightly increased from 2021 when it was 11580000 per person and 23160000 for a married couple. If the second spouse lives to at least January 1 2026 and the estate is worth 10 million the taxable estate after the exemption is 4 million. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006.

For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. Partner with Aprio to claim valuable RD tax credits with confidence. Ad Look For Awesome Results Now.

The Estate Tax is a tax on your right to transfer property at your death.

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Your Estate Plan Don T Forget About Income Tax Planning Isdaner Company

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Current Law 2026 Biden Tax Proposal

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

River Valley Law Firm 2022 Estate And Gift Tax Numbers To Know Facebook

Estate Tax Definition Tax Rates Who Pays Nerdwallet

Estate Tax In The United States Wikipedia

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

New York S Death Tax The Case For Killing It Empire Center For Public Policy

2020 Estate Planning Update Helsell Fetterman

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Four Estate Planning Ideas For 2022

Federal Estate And Gift Tax Exemptions Increase For 2022 Paul Premack Probate Estate Attorney