rhode island tax table 2019

The Rhode Island Department of Revenue is responsible for. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

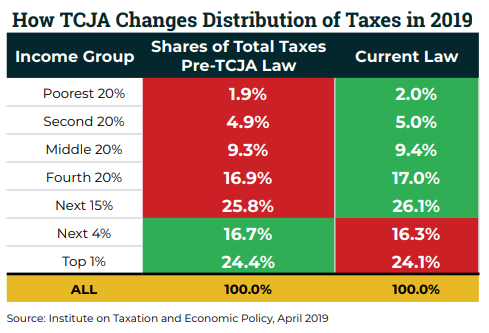

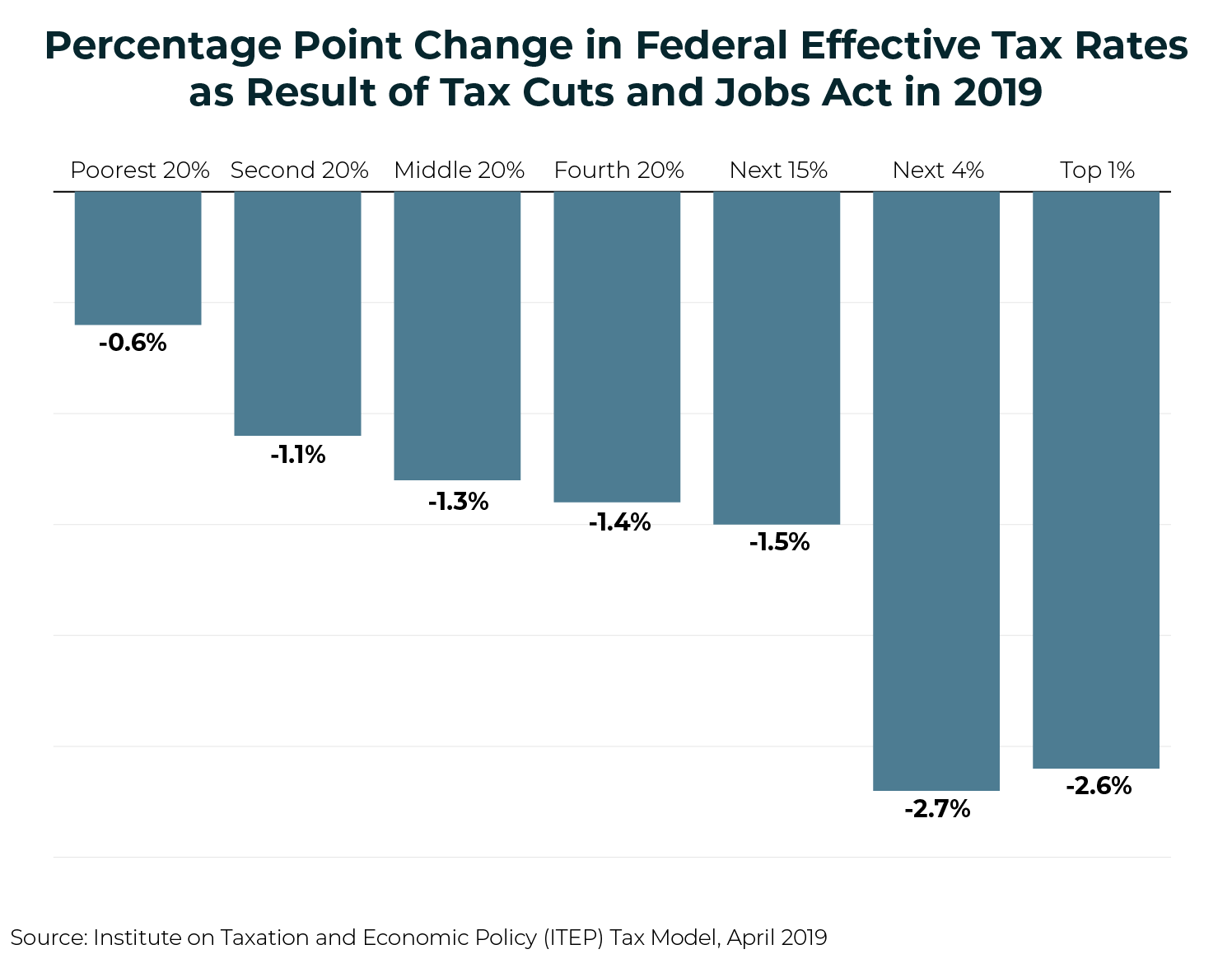

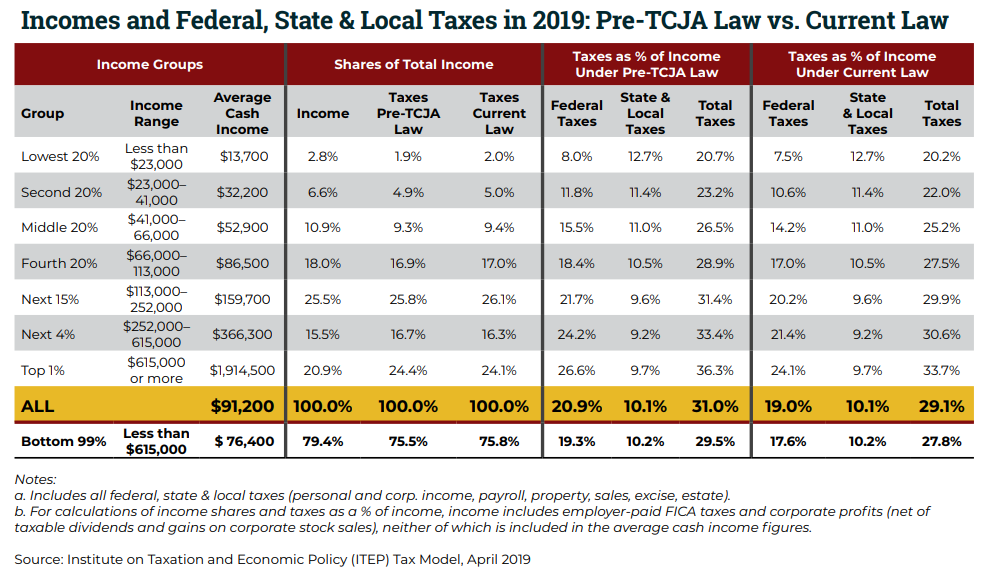

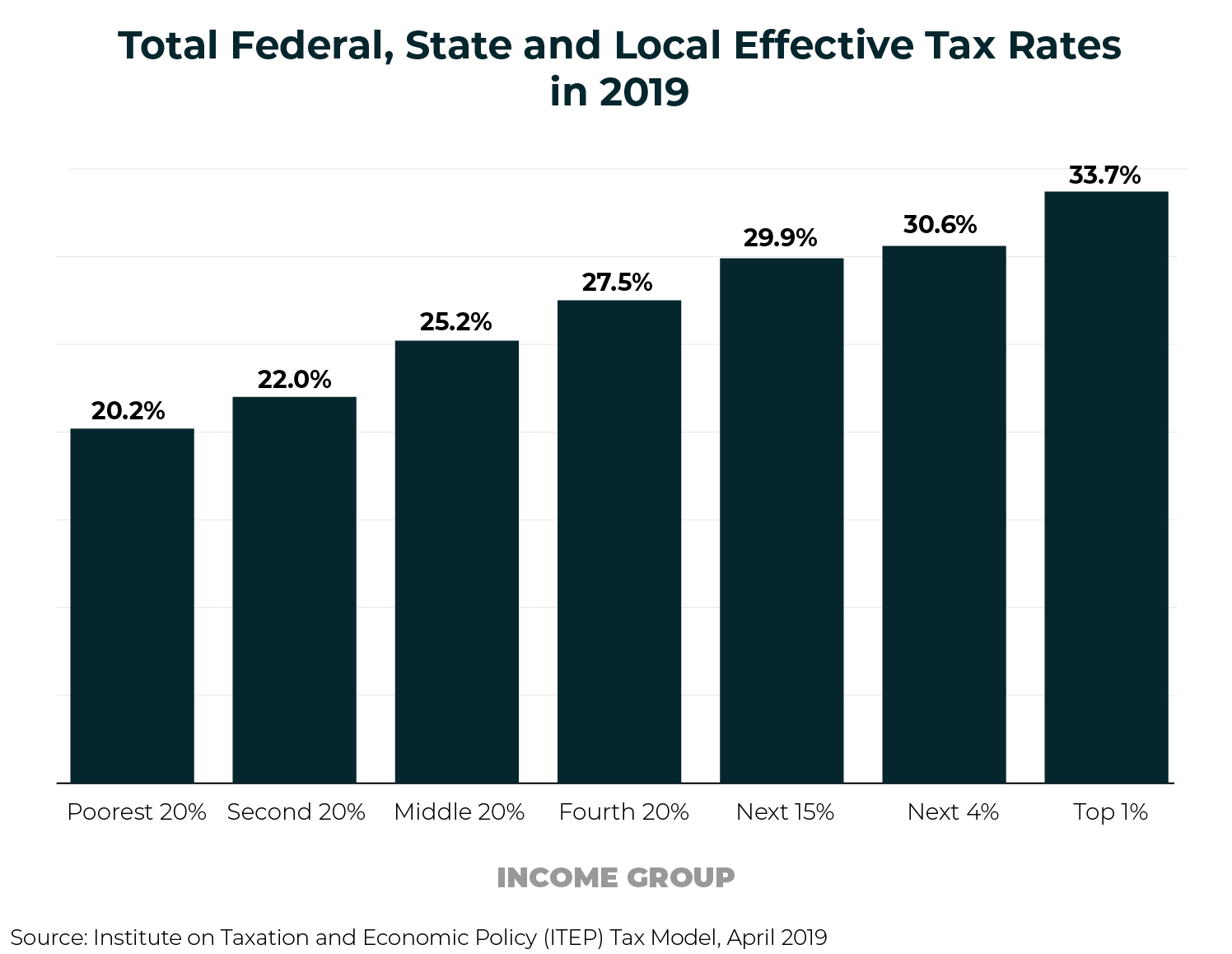

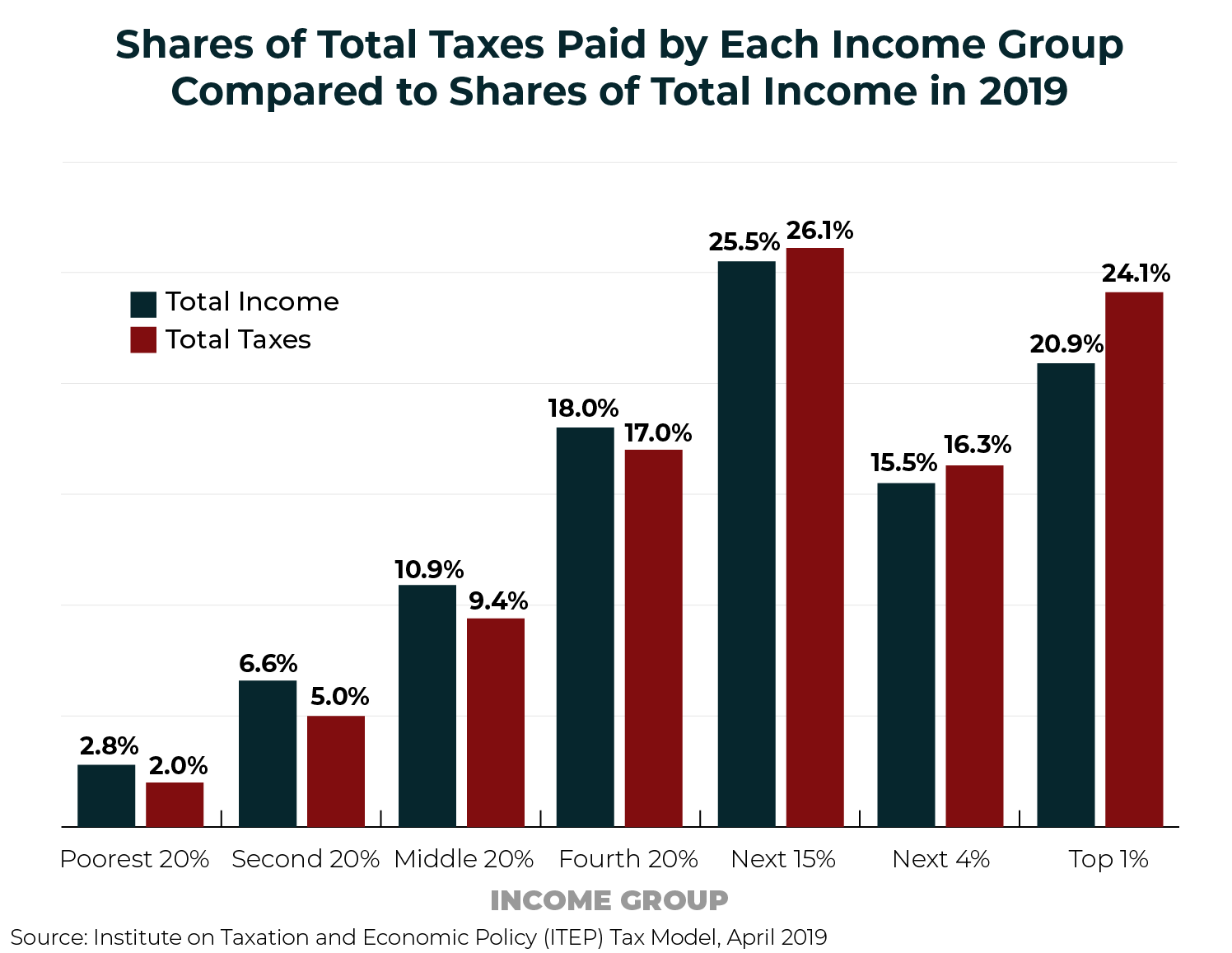

Who Pays Taxes In America In 2019 Itep

However if Annual wages are more than 221800 Exemption is 0.

. Prices to suit all budgets. Check the 2019 Rhode Island state tax rate and the rules to calculate state income tax. The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Ad Find process serving you can trust read reviews to compare. Find the perfect tax cpa with Thumbtack. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

2019 IRA and Roth IRA Contribution Limits. A list of the 2019 withholding tax filing deadlines is available here. Find your income exemptions.

Rhode Islands income tax brackets were last changed one year prior to. Find your gross income. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Letha Fallis September 10 2015. Ad Register and Subscribe Now to work on your RI DoT Form RI-1040NR more fillable forms. Exemption Allowance 1000 x Number of Exemptions.

If you live in Rhode Island and are thinking about estate planning this guide has the information you need to get started but professional help in the form of a financial advisor can help you whether your planning an estate or dealing with any other financial. Get the app get things done. How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales. Tax rate of 375 on the first 65250 of taxable income. Rhode Island Income Tax Rate 2022 - 2023.

That sum 122344 multiplied by the marginal rate of 72 is 8809. It kicks in for estates worth more than 1648611. Rhode island tax table 2019 Thursday August 11 2022 Edit.

Find your pretax deductions including 401K flexible account contributions. One Capitol Hill Providence RI 02908. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

IRA and Tax Tables 2019. The Rhode Island State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The Rhode Island tax rate is unchanged from last year however the.

Calendar year 2018 Forms W-2 and RI-W3 Reconciliation of Personal Income Tax Withheld by Employers are due by January 31 2019. Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Cpi April 2021 Inflation Speeds Up.

Free Unlimited Searches Try Now. The Rhode Island Division of Taxation has released the. The top rate for the Rhode Island estate tax is 16.

Ad Get Rhode Island Tax Rate By Zip. Find your income exemptions. This means that these brackets applied to all income earned in 2018 and the tax return that uses these tax rates was due in April 2019.

For more information on Rhode Island withholding tax call 1 401 574 8829 or see the Divisions website.

2019 Amc Theatre Summer Movies Deal For Kids 4 Movie Snack Pack Movie Snacks Summer Movie Summer Fun For Kids

Barry Ritholtz Author At The Big Picture Big Picture Weekend Reading Germany And Italy

Pin By Finance Of America Mortgage On Finance And Real Estate Markets Real Estate Marketing Finance Marketing

Delaware State Univeristy Calander University Calendar Academic Calendar Delaware State

Who Pays Taxes In America In 2019 Itep

Collin County College Calendar Collin County Calendar Board College

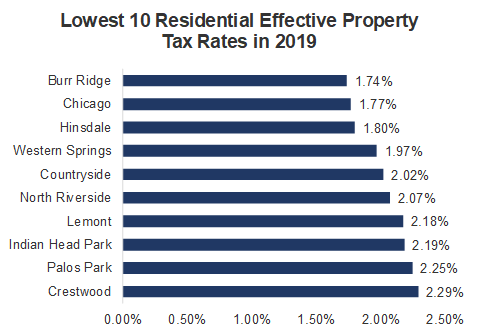

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

A New Study Published In September 2018 Examining Tax Havens Titled The Missing Profits Of Nations Found Tha Tax Haven Small Island Developing States Ireland

State Corporate Income Tax Rates And Brackets Tax Foundation

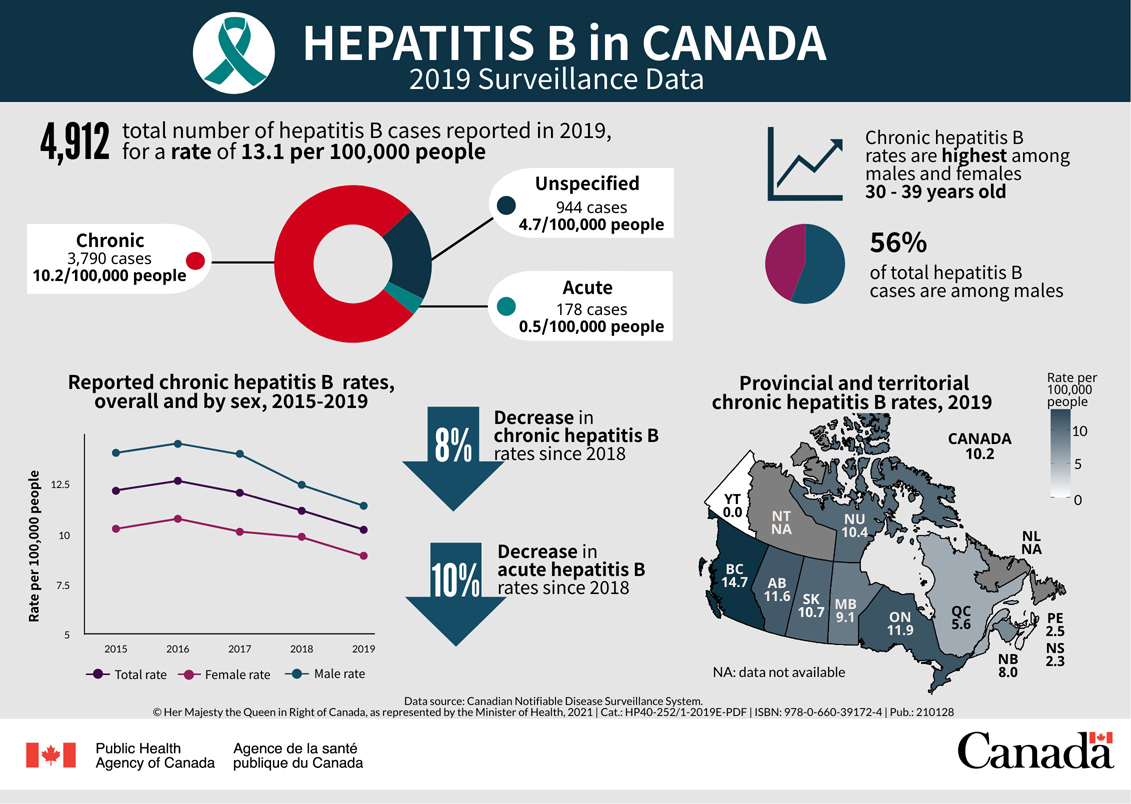

Hepatitis B In Canada 2019 Surveillance Data Canada Ca

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Seal Of Connecticut Connecticut State Seal Connecticut Student Loan Forgiveness Student Loans

Pin By Explore My Journey On Uttarakhand Holidays 2019 Sightseeing Breakfast Buffet Uttarakhand

County Surcharge On General Excise And Use Tax Department Of Taxation

Summer 2019 A Z Bucket List For Kids And Families In Rhode Island

Who Pays Taxes In America In 2019 Itep

Sources Of Personal Income In The United States Tax Foundation